LoanDepot isnt a financial. They’ve been noted for its on line platform and easy application procedure. Through its Mello Smartloan program, borrowers is also complete files online and get pre-accepted in as little as 10 minutes.

Borrowing requirements is actually more compact, in just a rating out of 580 needed for FHA finance. Conventional money and Va money wanted a rating out of 620. The lowest-attract finance, the brand new Jumbo financing, need a get away from 700.

If you would like the private contact away from a local financial, envision a great HELOC off TD Financial. TD Lender keeps one of the best customer service recommendations inside the industry, in addition to their funds do not have minimal draw. You could obtain between $25,one hundred thousand and you can $five-hundred,00 to pay for small or large strategies.

But, TD Financial charge even more extra charges than other lenders. And since they’ve been a local lender, they merely provider fifteen Eastern Shore says and Washington, DC.

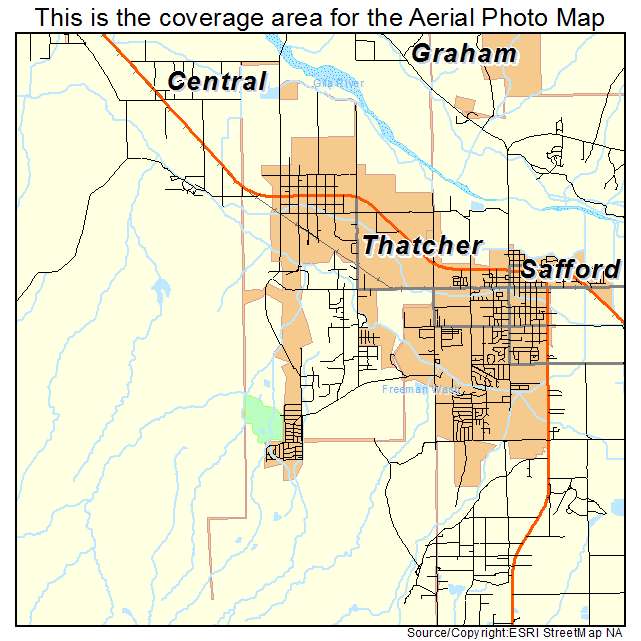

Truist, previously SunTrust Home loan, is yet another local financial found in the the southern part of. They services really states out of Mississippi to Virginia and you will east in order to new Atlantic coastline, for instance the Region from Columbia. However they provide on line services every-where however in Alaska, Washington, The state, and Oregon.

Truist is renowned for its affordable financing cost, which are far lower as compared to sector average. They costs limited charges, and you can rating an excellent preapproval letter in as little as twenty four hours. All of the Truist finance want a minimum credit rating out of 620.

Continuing the brand new motif away from local banking companies, Freeze Bank does organization just from the county regarding Colorado. Therefore, only Colorado residents will enjoy the well-charged HELOCs. Additionally have to go to just one of their twigs so you’re able to romantic on your own credit line; there is no on the web credit site.

Frost Bank HELOCs incorporate a 10-seasons mark period, followed by a good 20-12 months installment months. Qualifying borrowers get an apr as low as 3.74%, and you will save yourself an extra 0.25% by simply making automated payments regarding a freeze bank account.

Profile is different from the other lenders with this checklist just like the it is an online company without stone-and-mortar presence. So it reduces their overhead, in addition they can violation men and women discounts to their clients.

Figure has the benefit of HELOCs with cost as low as step three.24%, and discovered your money contained in this five days. The financing score dependence on 620 makes clickcashadvance.com payday loans near me no bank account sense, while the mortgage-to-worthy of ratio is as highest as 95%. The loan origination percentage out-of cuatro.99% is reasonable, however might have to pay regional recording charges.

M&T Bank is actually an inferior bank, repair multiple Eastern Coastline says southern area of new The united kingdomt and northern away from North carolina. They provide HELOCs with that loan-to-worthy of proportion as much as %, with rates as little as 2.99%. Borrowers can pick ranging from repaired and you can varying notice, with different requirements for each. You will additionally pay zero charges or settlement costs if you take about three years to repay your balance.

A good HELOC is actually an alternate mortgage enabling people so you can acquire against their residence and you will safe reasonable capital. Far more especially, yet not, people can use new equitable updates he has got managed to create in a house because a swimming pool regarding finance so you can obtain from. For that reason, HELOCS was similar to next mortgages. Still, instead of acquiring one to lump sum payment, borrowers are given a good rotating borrowing (not unlike a charge card) reflective of their fair updates in the home. Thus, individuals need to have at least 15% in order to 20% fair need for the house (with respect to the underwriter).

نشانی ایمیل شما منتشر نخواهد شد. بخشهای موردنیاز علامتگذاری شدهاند *